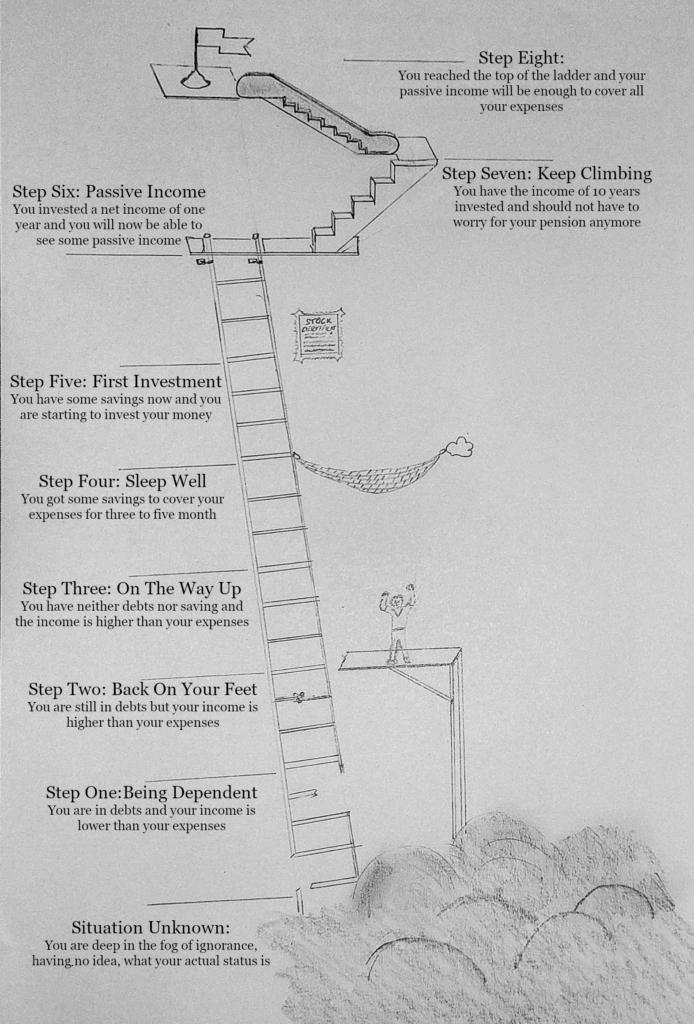

The Financial Ladder

Identify And Improve Your Position On The Financial Ladder

Today we are trying to find out about your personal financial situation. After reading this site, you should be able to decide how to set a realistic goal on the financial ladder for yourself!

To begin, let’s assess the current state of your finances by identifying the step you’re on in what’s commonly referred to as the financial ladder. This ladder comprises crucial stages that guide your journey toward financial well-being. Our primary objective is to pinpoint your current position on the ladder, enabling us to determine the necessary steps for a swift ascent. Once you’ve established your starting point, consider your financial ambitions and strategically set a goal at the ladder. This deliberate planning will pave the way for an efficient climb towards your financial objectives.

Situation: Unknown

As you can see, the worst-case scenario would involve lacking a comprehensive overview of your finances. To make informed financial decisions, it is absolutely crucial to possess a precise understanding of your current financial landscape. This entails knowing the exact figures: how much money you have, your income, your expenses, and whether there’s any surplus available for savings, investments, or debt repayment. This knowledge forms the foundation for effective financial planning and responsible decision-making.

If you need help to find out about your current state, you can find a detailed explanation right here.

If you already have a good overview, congratulation: you have found the ladder. Now we have to see, where you are on this ladder.

Step One: Being Dependent

The initial and most precarious stage is dependency. Currently positioned on this rung of the ladder, it’s precarious as it’s relatively easy to slip down and face potential loss. If you find yourself in debt with income trailing behind expenses, urgent measures are to being taken. Securing a job or a supplementary source of income is paramount. Simultaneously, a drastic reduction in expenses is necessary. As long as you are in this dire situation, complete dependence on others to cover your costs is evident. The critical focus should be on attaining a stable income to break free from this precarious situation. For additional guidance and assistance during such challenging times, please read this text on how to get help when you are unable to pay for your debts.

If you’re without debts but your income falls short of your expenses, you’re essentially on the same step. It’s merely a matter of time before challenges arise in meeting your financial obligations. The crucial distinction lies in obtaining a stable income that aligns with your expenses. Once achieved, this transition enables you to leap two steps ahead on the financial ladder.

Step Two: Back On Your Feet – First Major Goal

In the process of reducing your debts, your income has surpassed your expenses, including monthly debt payments—an encouraging step forward. Remarkably, approximately 12% of the current U.S. population has yet to achieve this pivotal milestone. Congratulations on surpassing this initial hurdle! Now, the focus should shift to eliminating your debts as fast as possible. Every dollar directed toward your credit has a substantial impact, progressively reducing the interest paid to the bank. A detailed explanation about why it is really important to get out of debts can be found here.

Step Three: On The Way Up

Upon successfully clearing all your debts, you’ve advanced to step number three. This marks a significant turning point, making it considerably easier to accumulate wealth and ascend the financial ladder. With no ongoing debt repayments, you now have the opportunity to slowly increase the amount of money you can retain and save each month. Notably, as of 2020, 38% of the United States population had yet to achieve this stage. While a commendable milestone, there’s further work ahead—specifically, saving money to progress to step four! For more Tipps and Tricks on how to get to the next step, please read this guide: <coming soon>

Step Four: Able To Sleep Well – Second Major Goal

Having accumulated enough savings to cover your expenses for three to five months is a commendable achievement. This financial buffer provides a sense of security, mitigating concerns about unexpected expenses such as car repairs. However, determining the ideal amount to start considering investments is contingent upon your individual circumstances.

Consider various factors, such as whether you own a house or rent, your reliance on a car for work versus using public transportation, the availability of public health care or your health insurance coverage, and whether you have dependents. The answers to these questions shape your financial landscape.

If you want to read about the appropriate amount to set aside, safeguarding against setbacks in the face of unforeseen events, you may find valuable insights in this guide on determining the optimal savings for your situation.

What Is Your Goal On The Financial Ladder?

At this stage, it’s time to find your financial goal on the ladder.

- You have the option to relish the present, indulging in holiday trips, acquiring gadgets for amusement, and maintaining a modest safety margin in your bank account. However, this choice ensures you remain on step four of the ladder. It’s crucial to acknowledge that if step four serves as your ultimate goal, contemplating the adequacy of your pension to sustain this lifestyle in the long run is imperative.

- Alternatively, embarking on the journey to step five involves considerations such as starting a family, continuing to work, potentially acquiring a house, and diligently saving for a comfortable life and a legacy for your loved ones. This path ensures not only present affluence but also a secure standard of living in your later years, possibly culminating on step six.

- For those trying to get rich as fast as possible, step seven beckons. This entails stringent saving practices, abstaining from non-essential purchases, and swift, comprehensive investments. The ultimate aspiration is step eight – retiring at the age of 35, liberated from work-related commitments. The decision to tread this ambitious path demands strategic financial planning and unwavering dedication to financial goals.

All theses goals are equally valid and possible, now that you are on step four.

Step Five: First Investment

By this time, you should have a clear vision of your desired goal on the financial ladder. Now, to ascend further, it’s opportune to let your money work for you through strategic investments. Depending on your circumstances, there are various investment avenues to explore, with the stock market being one of the most common. While 58% of the American population engages in stock market investments, only 15% of Germans partake in this financial endeavor.

On this site, I will help you to decide how much of your money you could invest and what to do with any spare savings. Your First Investments

Given the multitude of investment possibilities, the internet is flooded with seemingly easy tipps for everyone with catchy titles like “Gettin’ rich within 3 years” or “Become a billionaire with these three easy tricks.”

For a more grounded perspective tailored to the average individual, explore the advice provided in my investment section. (coming soon) There, you’ll find a comprehensive guide detailing the most common investment products, complete with their pros and cons. This resource aims to offer practical insights to help you make informed decisions in your investment journey.

Step Six: Your Money As Your Co-Worker – Third Major Goal

Upon investing your net income for a year in the stock market, you’ll start experiencing a noticeable shift in your financial landscape. On average, your stocks will now exhibit growth equivalent to about one month’s worth of your income each year, contributing automatically to your ascent on the financial ladder. There are some things you can and should do, while enjoying to watch your stock portfolio growing to ensure it will stay healthy. Please have a look here, to learn about responsibly growing your investments to the next step.

Step Seven: Still Climbing The Financial Ladder?

Once you have invested the net income equivalent to approximately 10 years in the stock market, concerns about your pension should dissipate entirely. At this juncture, you can choose to reap the rewards of your efforts, enjoying a passive income generated from dividends that could provide you with the equivalent of four months’ wages annually, all while your stocks continue to grow.

Depending on your age, you might contemplate gradually reducing your daily work commitments. For detailed insights into extracting a monthly income from your portfolio, delve into this resource for a comprehensive guide.

Step Eight: The Top Of The Financial Ladder

The ultimate goal is to achieve sufficient passive income to effortlessly cover all your expenses, marking the pinnacle of the financial ladder. At this zenith, you gain the freedom to work for pure enjoyment or embark on global adventures. However, at this stage, the risks are minimal, barring potentially imprudent decisions like acquiring a yacht on credit without insurance and navigating it into a bridge. A prudent strategy involves maintaining your stock portfolio and relying on the dividends to fund your every expense, ensuring a sustained and enjoyable financial journey.

Where To Set My Financial Goal?

Regardless of your current situation, the objective is to progress to the next step on the financial ladder swiftly. Expedite this transition and subsequently establish a long-term goal.

For detailed guidance on advancing to the next step, explore the links embedded in the text for comprehensive instructions on ascending the financial ladder.

2 thoughts on “The Financial Ladder”