Step Two: Paying Back Your Debts

Being Back On Your Feet And Paying Back Your Debts

Congratulations on achieving the significant milestone of progressing from step one, where your income fell short of meeting debt obligations, to step two, where you are regaining financial stability! Now that you have the means to start paying back your debts, let’s look at strategies for doing so as fast as possible. Before starting your debt repayment journey, conduct a thorough examination of your finances. Take note of all outstanding debts owed to individuals or companies and assess the current balance of your savings. This foundational step will provide a clear picture of your financial standing and guide your approach to expedited debt repayment.

Manage Your Debts

So for every single credit, write down the following information:

Amount of money you owe, how long the credit runs for, the lending rates, monthly repayment amount, creditor, what you got for this credit

The table for your credits should look like this:

| No. | Amount | Months | Int. Rate | Repayment | Creditor | Item |

| 1 | $ 12.000 | 43 | 6,5% | $ 305 | Cars Cars | Your Car |

| 2 | $ 1.250 | 24 | 6,5% | $ 55 | PhoneShop | Newest Phone |

| 3 | $ 4.350 | – | 15,75% | $ 57,9 | VISA Card | TV, Gaming Console, Headset |

| 4 | $ 6.300 | – | 20,45% | $ 107,4 | American Express | Car Repair |

| 5 | $ 5.000 | – | 0% | $ 0 | Your Mum | Mum helps out |

Let’s break down four distinct types of debts that you may be dealing with. Firstly, there’s the car loan, which could be essential for your daily commute to work. The second type is associated with an expensive phone purchase, with a repayment plan spanning two years. Next on the list is the credit card debt, encompassing expenses related to gaming experiences and car repairs. Lastly, you might have a debt owed to your mother, who graciously extended financial assistance in your time of need. Identifying these various debts is crucial as we navigate through strategies for efficient and sustainable repayment.

How Much Money Does The Creditor Get Each Year?

In our example, the annual interest you’re incurring amounts to $2,834.72.

This represents only the costs for borrowing that money, and if your monthly budget allows for only $240 in repayments, it becomes apparent that eliminating your debts within a reasonable timeframe would be challenging. Notably, credit cards tend to carry the highest interest rates, ranging from 15% to 30% annually. The overarching objective is to minimize the interest payments made to the bank; your responsibility isn’t to make your creditor rich!

Get Rid Of Your Debts

To expedite debt reduction, consider tapping into any available savings to make immediate payments. Additionally, explore the possibility of returning recent purchases for a refund, especially items like the gaming console, TV, and headphones, which may not be essential at the moment. This swift action provides a rapid reduction in your overall debt.

If it’s feasible to allocate extra funds each month, direct these towards repaying more than the minimum balance. This approach accelerates the reduction of credit costs, leading to a faster decrease in monthly repayments. The cumulative effect of this strategy is akin to a snowball, rapidly diminishing your debts.

As an illustrative example, if you could allocate an extra $100 each month to your car credit, the total repayment amount would be $12,850 within 32 months instead of $13,130 within 43 months. This demonstrates the significant impact of additional payments in expediting your journey towards financial freedom.

Which Credit To Pay Back First?

Your primary focus for repayment should be directed towards the most expensive credit, which, in our example, is the AMEX credit card with a 20.45% annual interest rate.

Each month, nearly $110 goes toward covering the interest alone, leaving no room for chipping away at the principal debt. However, if you can make a substantial one-time payment and reduce this credit by $2000, you stand to save $35 in interest every month. While this might not initially seem like a significant amount, it’s crucial to recognize the snowball effect that will ensue. Small savings compound and accumulate over time, turning into substantial reductions in your overall debt burden.

In cases where multiple credits share the same interest rate, prioritize repayment of the smaller one first before moving on to the next higher one.

Use This Order For Paying Back Your Debts!

The optimal strategy for debt repayment is clear: prioritize the credit with the highest interest rate first. If you encounter two credits with the same interest rate, begin by repaying the smaller one. Observing each credit diminish one by one, much like snow melting in the sun, serves as a powerful motivator until you are entirely debt-free. Applying this logic to our example, the order would be to pay back credit number 4, followed by 3, 2, 1, and then 5.

Here’s a valuable piece of advice: if you ever find yourself in a position to repay debts to your mother, prioritize credits 4 and 3. Once those are settled, consider repaying your mother promptly, showcasing your commitment to financial responsibility. This not only relieves you from the burden of those particular debts but also strengthens relationships by honoring financial commitments.

Can I Reduce My Credits Interest?

The faster you pay back your credits, the less interest you pay, as the total costs will stack for every single month.

One strategic approach to efficiently manage your debts is through a debt consolidation plan, which involves collaborating with your bank to significantly reduce the interest rates for specific credits.

In a debt consolidation plan, the bank consolidates all your high-interest credits into a single new credit with more favorable conditions than those typically associated with credit card interest rates.

Lets Have An Example For Paying Back Your Debts!

What If You Pay The Absolute Minimum?

In our example, the total debt amounts to $23,900 (excluding the money owed to your mother). The absolute minimum required to repay your debts is $626 per month, adhering to a minimum payment percentage of 2.5% of the closing balance on your credit cards. Under this minimum payment scenario, you would end up paying a substantial $7,846 in interest to your creditors, with the final debt cleared in nearly six years, bringing the total repayment to $36,746. It’s crucial to recognize that this approach involves a prolonged repayment timeline and substantial interest payments. Exploring strategies for accelerated repayment and interest reduction can significantly improve your overall financial outlook.

What If You Act Smarter?

Consider this scenario: If you allocate the freed-up money from paying off the first credit towards tackling the most expensive debt, a noteworthy transformation occurs. After precisely two years, you have an extra $55 available to contribute to your priciest debt. By the 3.7-year mark, this surplus increases to $305, allowing you to continue chipping away at your debts. Implementing this strategy significantly compresses the time needed to clear all debts to precisely four years and one month.

Notably, this approach results in a total interest payment of $6,986, saving you two years of repayment and nearly $1,000. This strategic adjustment not only accelerates your journey to debt-free status but also optimizes your financial outcomes by minimizing interest expenses.

Act Smart And Start With $ 2000 Extra

In a parallel scenario, but with an extra $2,000 available for immediate repayment, the dynamics of your debt clearance undergo a profound shift. With this surplus, you can settle all your debts in just 3.5 years, resulting in a total interest payment of $4,698. This adjustment saves you an additional $2,288 in interest payments.

This stark contrast illustrates the crucial importance of expeditious debt repayment. Every dollar invested in settling your credit contributes significantly to your financial well-being, offering tangible rewards in the form of reduced interest payments and a faster journey to financial freedom. This underlines the value of proactive and strategic debt management for optimal long-term financial outcomes.

The Consolidation Plan

Maybe this seems too complicated and you would really prefer to have someone handle this for you. If you just don’t want to think about your debts any more, the best choice will be to have a good consolidation plan for your debts. All your debts are weighed together and you will get the average interest rate of your debts. That will usually help either reducing your monthly rates or reducing the interest rate, giving you an opportunity to get back on your feet again.

Is It Always Good To Get A Consolidation Plan?

No, it really depends on your debts, your financial situation and how long it will take you to pay back these debts. Feel free to go to a bank and talk to them about a consolidation plan. You can then calculate, how much it will benefit you.

Can You Trust Your Bank With The Consolidation Plan?

Absolutely, never trust your bank blindly. However, it’s essential to recognize that banks are profit-oriented entities. They aim to maximize their earnings from their customers, particularly through the sale of credit or consolidation plans. Their ideal scenario involves providing you with a plan that is affordable enough for you to barely manage the payments.

When approaching the bank, ensure you are well-prepared. Don’t hesitate to visit several different institutions and leverage the competitive market to your advantage. Communicate to each bank that you are actively comparing offers, mentioning specifics like, “The bank next door offered me a 2% lower interest rate. What can you do to improve your offer?” Engaging in this negotiation process can often result in a more favorable deal that suits your financial needs.

If you live in the United States, You can also check this website, to find some help close to you: https://www.usa.gov/debt

Paying Back Your Debts Is A Long Time Plan

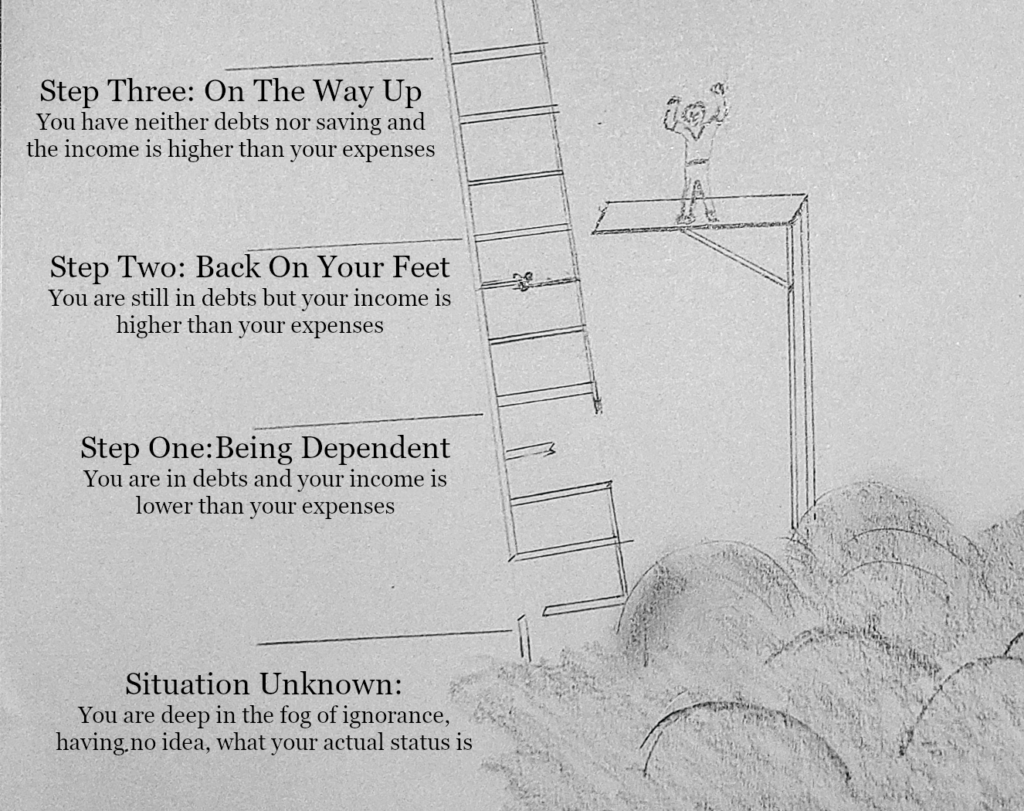

Paying your debts can take some time and there might be some ups and downs during this period. Maybe sometimes you will have some spare money to go on a fishing trip and buy yourself some nice things you always wanted. Most likely you will find some extra money every now and then to pay back your debts quicker. Maybe you will have some more changes in your live or earn less at your job and you would have to recalculate everything. If possible, try to stick to your plan and keep climbing the financial ladder. It is really hard in the beginning, but you will see, it will get easier for every step that you take. If you managed to get all your debts payed back, you are on step three of the ladder. Continue reading on how to get to start saving money!

4 thoughts on “Step Two: Paying Back Your Debts”