Situation Unknown: Financial Overview

Where To Start If Your Finances Are A Mystery??

Now first of all, establishing a solid financial foundation requires gaining a comprehensive overview of your financial landscape. It is absolutely crucial to understand precisely how much money you have, your income, and your monthly expenses before making any informed financial decisions.

Think of this situation as being adrift at sea in a boat, faced with the crucial decision of which direction to navigate. Even if you could find out where east, west or south should be, without a clear understanding of your approximate location, making the right decision to reach solid ground swiftly becomes an elusive task.

To remedy this, equip yourself with a pen and paper, or fire up your computer to create an Excel spreadsheet and begin collecting your own financial data. This proactive step serves as the compass guiding you through the financial sea, helping you chart a course toward stability and prosperity.

What Is Your Income?

Document each recurring source of income, breaking it down into a monthly figure for clarity. For instance, if you receive an additional $600 annually, the monthly equivalent would be $50. All forms of income are pertinent, provided they are dependable over a sustained period:

- Monthly Salary:

- Your regular earned income from employment.

- Business Profit:

- Consistent profits generated from your business endeavors.

- Bonuses:

- Periodic bonuses received as part of your compensation.

- Passive Investment Income:

- Earnings from investments, requiring minimal active involvement.

- Real Estate Rental Income:

- Income generated from renting out real estate properties.

- Alimony:

- Financial support received from a former spouse.

- Unemployment Benefits:

- Financial assistance provided during periods of unemployment.

- Pocket Money:

- Additional funds received regularly for personal expenses.

- Emergency Aid:

- Assistance received during unforeseen financial crises.

- Insurance Payments:

- Payouts from insurance policies that provide financial coverage.

- Orphan’s Pension:

- Regular pension payments for individuals who have lost their parents.

- Widow’s Pension:

- Periodic payments for individuals who have lost their spouse.

After writing down everything that will give you some income, add it up and you will have your true monthly income.

What Are Your Expenses?

Now comes the challenging part, as a multitude of expenses demand consideration. A helpful strategy is to look into your bank account’s payment history to identify all expenditures. Don’t forget to include any debt payments in this process, as these play a crucial role in shaping your financial overview. Here’s a condensed overview, highlighting the key items on the list:

- Housing

- Monthly Rent

- Mortgage or debts payments

- Sewer fees, Garbage disposal

- Mobility

- Car repairs

- Debts payments for the car

- Gas

- Annual Check and Service

- Public Transport fees

- Insurance

- For the House

- For the Car

- Health Insurance

- Legal protection insurance

- Private liability insurance

- Energy

- Electricity bills

- Gas bills

- Water

- Multimedia

- Costs for telephone and internet

- Debts payments for newest phone that you totally needed

- Clothing for you and the family

- Food for you and the family

- Restaurant bills

- Expenses at the store

- Kids

- Daycare center

- Alimony

- School Equipment

- Luxury goods

- Holidays

- Traveling

- Membership at the Fitness Center

- ….

These are just some things that you should consider, please feel free to add anything, that I did not mention. After writing down the list and how much you actually spend for each point, there should be a number for your monthly expenses.

By now, you likely have a clearer picture of whether you’re facing significant financial challenges. If your income falls short of your expenses, swift action has to be taken. To gauge the severity of the situation, let’s turn our attention to your savings.

Do You Have Any Savings Or Debts?

To finalize your financial overview, let’s assess the status of your savings. Check your bank account for the most up-to-date savings balance and review your mail for any recent reminders of outstanding debts. We’re focusing specifically on liquid assets that can be readily accessed, so exclude considerations of net worth such as property or vehicles. Concentrate solely on funds immediately available to you:

- Money in the bank

- Company shares

- Government bonds

- Other bonds with a solid rating

- Gold you buried in the backyard

- Bitcoins if you can actually say how much they are worth in that second

Please do not add:

- Money that you borrowed someone that promised, that he would win in the next poker game.

- Your Grandmothers money because she is quite old already.

- That vase you bought at a market from a guy who promised it is actually several thousand years old but he really needs that money for the bus so $ 10 would be fine

In addition, write down what your debts are and see, if your savings are higher than your debts.

Your Financial Overview Is Done!

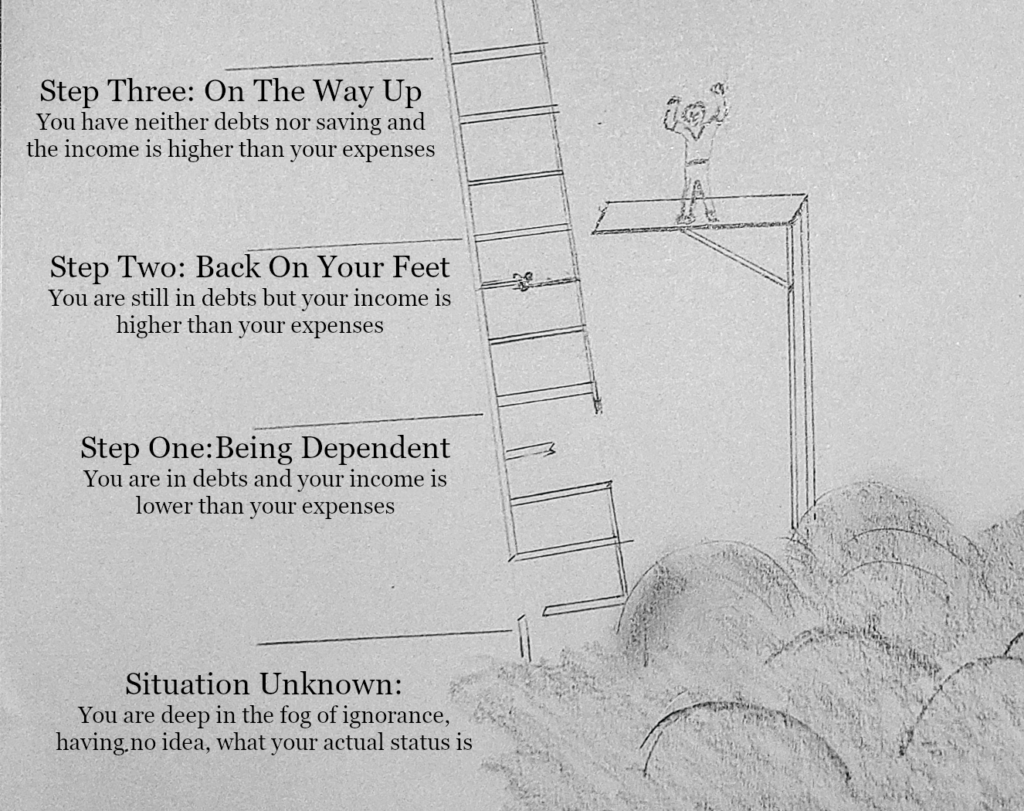

After writing down all your savings, it is time to find out where we stand on the financial ladder:

Step 1: You are in debts and your income is lower than your expenses. You need to act now! Here, you can find some advice for your situation! If you are broke but not in debts and your income is lower than your expenses, that is not a lot better. You are on a timer.

Step 2: In debts but income is higher than your expenses. Good for you, here is the guide on how to start climbing the ladder today!

Step 3: You are without any debts anymore and your income is higher than your expenses. Save some money, here is some advice on how to do so

Step 4: After all you managed to get some savings and there is no need to panic, if the refrigerator needs to be repaired. How much savings do you need in your situation? Read it here

Step 5: You are starting with your first investments. I would recommend reading this guide on how to decide how much to invest and another guide in what to invest in in your current situation.

Step 6: Most likely you did already know what your income and savings have been before reading this text. Still if you would like to get some advice on how to grow your investment, please keep on reading here.

Step 7: You have plenty of money in the bank and in shares. Are you still saving more money or are you already enjoying some passive income? Here are some tips on how to get your passive income going

Step 8: Congratulations! There is no need for you to work anymore and you can spend your time reading articles like this.

Want to read more about climbing the financial ladder? Click here to learn about the financial ladder and how to climb it.