Step Four: Start Investing?

The question of when to start investing is as crucial as how to begin. Ideally, start as soon as possible to allow your money ample time to accumulate interest. It’s essential to invest money that you won’t need in the near future, ensuring you stay invested for an extended period. Before delving into investing your first $1,000, ensure you have a financial cushion in your bank account. Once you’ve amassed enough funds to initiate your investment journey, you’ve achieved the second major goal on the financial ladder. Now, you can rest easier, knowing that you have sufficient emergency funds in your bank account.

Your Savings Before You Start Investing

One of the big questions is: how much savings should I have before I should start investing? Now there is no easy answer, that would fit for everyone.

Your specific circumstances will play a significant role in this decision. Factors such as homeownership, reliance on a car for work, and the availability of public transportation can influence the necessary savings for repairs and maintenance. Additionally, the healthcare system in your country and your family responsibilities, especially if you have children and a non-working spouse, are crucial considerations.

In essence, the amount you should have in savings before starting to invest depends on your unique situation and financial responsibilities. It’s advisable to carefully evaluate your individual needs and financial goals to determine the appropriate savings threshold before you start investing.

How Much Money Do You Need On Your Savings Account?

If you have read the last article about how to start saving money, you would have figured, that you should try to save some money to different saving accounts. Each account has a different use and should be well filled, before you can start investing. You can combine some of these accounts for a better overview, but still you should have the needed money on that account. We start of with the first two savings accounts that everyone should have:

Savings: This account exists for saving some money on a regular basis and having the best overview on how much you have saved. If you start investing, use the money from this savings account to see, how much you are able to invest.

Emergency Funds: Here should be enough money to be able to keep paying your bills in case you would lose your job. In general, there should be the equivalent of three times your monthly spending. So if your monthly income is $2.500,- and your monthly spending is $2.000,- you should seek to get $6.000,- on this savings account and then never touch it again.

Learn more about your savings accounts and how to set them up properly before you start investing!

There Are More Things To Consider!

In addition to your primary accounts, it’s essential to have a dedicated savings account for various purposes. While you can consolidate these funds, it’s helpful to break down specific allocations to determine the appropriate amount for each purpose.

Unexpected Things: Transfer a portion of your money into your “Unexpected Things” account each month. Despite the name, many events are not entirely unexpected. If the most unexpected case occurs, where nothing unexpected happens, feel free to transfer any additional funds to your general savings or treat yourself to a well-deserved holiday. Aim to allocate around 2.5% of your monthly income to this account, with a suggested threshold of $650.

House Maintenance: For homeowners, setting aside funds for potential repairs is crucial. As your house ages, repair costs may increase, so it’s wise to save about 2.5% of your monthly income for house maintenance. Unlike the “Unexpected Things” account, there’s no specific threshold for this fund.

Car Maintenance: If you own a car, having extra savings for potential repairs is prudent before diving into investments. Allocate around $500 to this fund, unless you’re driving a brand-new Ferrari.

Health Maintenance: For those living in countries with universal healthcare, this category may not be applicable. However, if you lack healthcare coverage, either invest in health insurance or build up savings. For an 80-year-old, allocate approximately $10,000 for medical expenses and funeral costs. Adjust this amount based on your age, subtracting around $2,000 for every decade younger. For example, at 40 years old, aim for $2,000 in your health maintenance account. While savings can help, consider obtaining health insurance for comprehensive coverage.

Extra Emergency Funds Before You Start Investing:

If you happen to be the only one with an income, add the equivalent of one monthly spending for each of your kids,

With all these information, lets add up some examples!

Savings As Young Single

If you’re a 30-year-old single individual residing in Germany, living as a tenant and utilizing public transportation, your approach to savings can be streamlined. To ensure financial stability, consider maintaining a savings balance equivalent to three times your monthly expenditures, with an additional buffer of $500 to $1,000 for unforeseen expenses. The remaining funds can be strategically invested, considering your relatively predictable financial landscape without immediate unexpected costs on the horizon.

Savings As Single Mother of Three

At 45 years old, you’re the sole financial provider for a household with three kids, reliant on your car for commuting and managing daily tasks. Residing in a house in the United States, you’ve achieved notable success, and your ability to save is commendable. To safeguard your financial stability, aim for an emergency fund equivalent to six months of your spending and allocate an additional $3,000 to $3,500 to maintenance accounts. Before delving into investments, ensure these funds are well-established. Regular transfers to a house maintenance account will mitigate the impact of substantial expenses, such as roof repairs.

Wealthy Family Father

At the age of 50, with two teenage kids and residing in your own house in Spain, accompanied by the convenience of two cars and your wife’s substantial income, your financial setting is commendable. Before venturing into investments, ensure you have an emergency fund equivalent to three months of spending, along with an additional $1,500 allocated for your cars and unforeseen expenses. It’s crucial to designate a monthly contribution to your house fund, allowing you to cover potential expenses related to homeownership. This balanced approach ensures financial security and provides a solid platform for future endeavors.

What is your goal on the financial ladder?

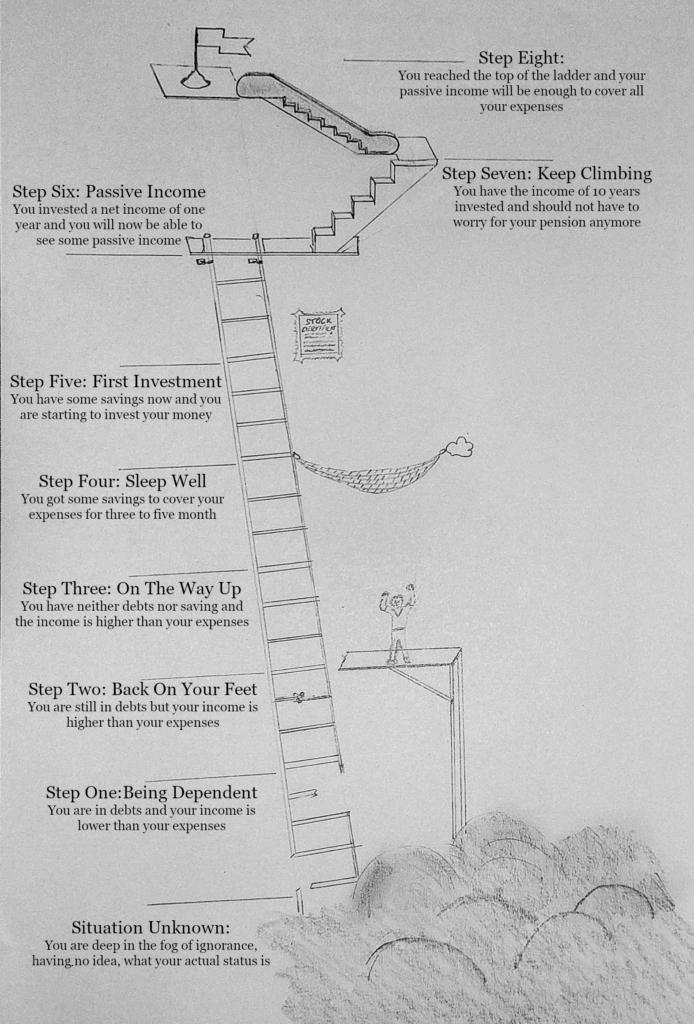

If your objective was to reach step four and attain a sense of financial security, congratulations, you’ve accomplished the task! As long as you preserve your emergency funds and sustain your wealth while retaining your job, you should be in good shape. However, if you’re eager to continue ascending the financial ladder, you’ll discover the advantages of investing and allowing your money to work for you.

The key concepts here are “passive income” and “early retirement.” Achieving some passive income requires climbing to step five on this ladder, but to truly experience the impact, aiming for steps six and beyond is advisable. If early retirement is your ambition, steps seven and eight are tailor-made for you. Personally, I aim to pass on passive income to my children, enabling them to embark on their work lives at step five, rather than starting from the bottom at step one.

Your Goal: Step Four, Start Investing?

As you should have reached your goal by now, just try to adjust your savings account every now and then to cope with inflation and maybe more expensive repairs for your house or car. The rest of the money: use it for whatever you enjoy most in life!

Your Goal: Step Five, The First Investment

If your goal is to start investing a little bit, just enough to compensate for inflation, just read on for the next chapter. You are already there and there is no reason for you not to invest some of your money.

Your Goal: Step Six, Passive Income

Do not work for the money, let the money work for you! That “simple” concept starts paying of as soon as you have some money invested. Depending on what you are invested in (Stocks, Photovoltaik, Reals Estate, …) it will take some time and money, but sooner or later you will feel the impact of your investment and the interest. If this is your final goal, stay invested and use the revenue to get yourself some holiday!

Your Goal: Step Seven, Retirement Plan

Not a lot of people will reach this goal. It means, that you either need a really good job, win the lottery or inherent some money and – most importantly – not spend too much money. This is an achievement not for days or months but for decades. If you invested about 10 years worth of your net income, your passive income will be massive, giving you at least 4 month of extra wages a year, dependent on your investment, with 7% revenue you would even get 9 month of wages just as a bonus. You should be really close to being able to be financially independent.

Your Goal: Step Eight, Financially Independent

Remain on step seven for ten years and you will automatically get to step eight. As soon as you are on step six, it will just work like that: stay cool and watch your money grow. Don’t buy some luxury cars, don’t get yourself that boat, that you would like to ride every three years. Just steady watch your money grow. In order to get to step eight, just see that you will get to step seven before you are 80 years old.

No matter what step on the ladder is your final goal, try to go step after step to reach your goal! So lets read on about the first investment! If you did not read the earlier steps on the ladder, you can find the summary and the link to all the previous steps right here!

3 thoughts on “Step Four: Start Investing?”