Step Three: Start Saving Money

Congratulations if you have just stepped up from step two and paid back all your debts!

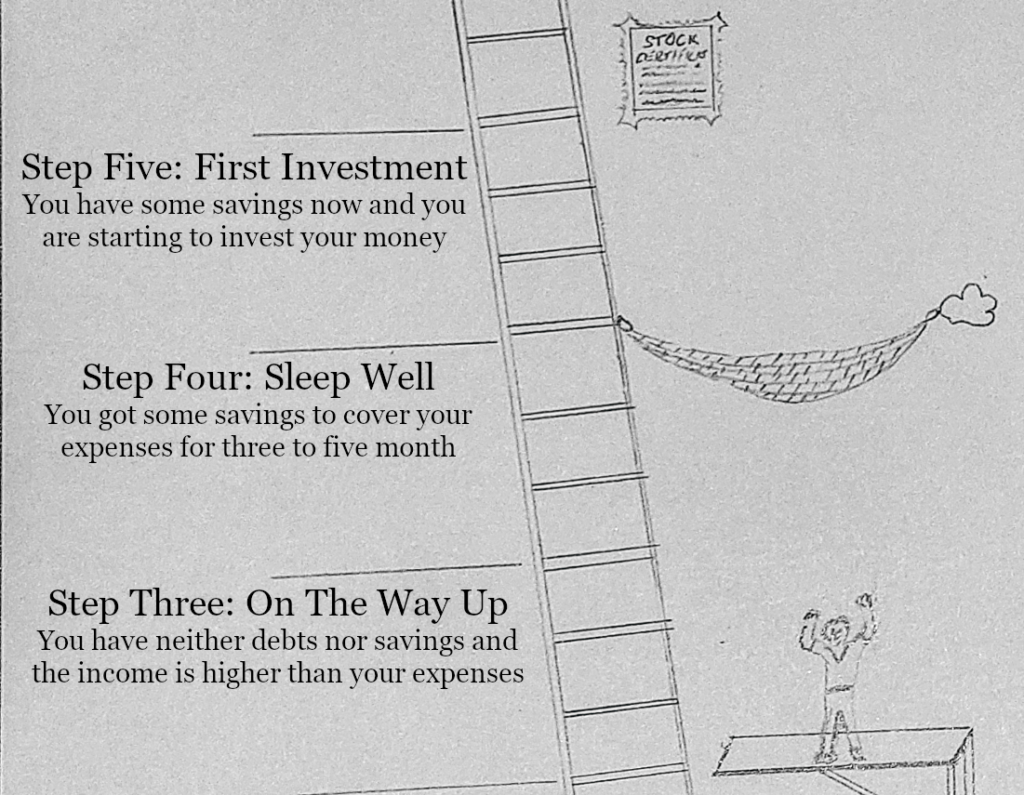

Freed from the weight of debt, your journey up the financial ladder becomes significantly smoother, allowing you to focus on building your wealth. This phase marks a shift in perspective – from anxiously watching debts dwindle to joyfully observing your money grow. With a clean slate, it’s an opportune moment to strategically set the stage for your future financial success.

Take the time to establish a robust foundation for future wealth. Construct enduring structures and employ effective financial tools that will stand the test of time, paving the way for decades of financial prosperity. This transition from debt management to wealth creation opens up a realm of possibilities for securing your financial well-being in the long run.

Important Tools For Saving Money

Your Checking Account

Maybe the most important tool for saving money in the next years will be your checking account. Serving as the central hub of your financial activities, every transaction from payments to paychecks will pass through this account. Opting for a reliable, long-standing bank is crucial for the stability of your financial foundation. It’s worth noting that a traditional brick-and-mortar bank is not a necessity; an online account suffices, provided you won’t incur additional charges at ATMs.

Important Things For Your Checking Account:

- No overdraft fees

- Low monthly Fee

- No additional fees for transactions

- No fees for going under a minimum deposit

- Bank should have some form of Governmental Insurance, so your money cannot be gone, if the bank fails for some reason.

Keep in mind, this will be your most important and most used tool for decades to come, so choose a checking account, that you are going to stick with.

The Saving Account

Your saving account does not have to be at the same bank as your checking account, it will be absolutely fine to have a savings account at a different institute. In fact, it’s advisable to seek a savings account that offers the highest interest rates. However, it’s essential to recognize that certain factors may outweigh a marginal increase of 0.05% in interest. Consider the following priorities:

- No Fees at all

- Governmental Insurance for your deposit

- No withdrawal limits

- Low minimum deposit

Have Several Saving Accounts

Open several different saving accounts and give them names accordingly to what you are saving the money for.

- Savings

- Emergency Funds

- Unexpected Things

- Extra Money

Designate the “Savings” account for regularly saving a portion of your paycheck. The “Emergency Funds” account serves a different purpose; it should ideally be filled once and, ideally, never touched again unless absolutely necessary. Allocate funds in the “Unexpected Things” account for unforeseen expenses like repairs or sudden events demanding immediate financial attention. Lastly, the “Extra Money” account is your reserve for additional savings, perhaps earmarked for your next holiday or a special purchase for yourself or loved ones. Clearly defining the purposes of each account ensures a systematic approach to your financial management.

How To Start Saving Money

Pay Yourself First!

Consider every transfer from your checking account to your savings account as paying yourself first. This means that as soon as your paycheck arrives, a portion of it should be promptly directed to your savings. If your employer deposits your wages on the 28th of each month, it’s advisable to automate a transfer to your savings account on the 2nd of the following month. Automation streamlines this process, ensuring that your savings receive their due without requiring manual intervention. This approach ingrains a disciplined savings habit, contributing to your long-term financial well-being.

Automatically Transfer Funds

Set an automatic transfer at your checking account to your saving accounts. This way, every month a specific amount of money will be transferred from your checking account. The automatization makes sure, that you will reach your minimum savings amount each and every month. Additionally, consider implementing a skimming order two days before your next paycheck. A skimming order directs any surplus funds beyond a set minimum amount to a designated savings account. For instance, if your skimming order is set at $500 and your checking account balance is $680 two days before your paycheck, it will automatically transfer the excess $180 to your “Extra Money” savings account.

How Much Can You Save Each Month?

If you have made it from step two, you should have already found out how much of your income you would need each month for your expenses and how much money you would have left. Until now, you should have used all the extra funds for paying back your debts, now it’s time to allocate the surplus funds to savings. A general guideline is to aim for saving at least 20% of your net income each month. If you’re just initiating your savings journey and don’t have an established emergency fund, consider directing 15% of your net income to “Emergency Funds” and 5% to “Unexpected Things.” Continue with this distribution until both saving accounts reach their respective thresholds.

Save Some Extra Money

When you receive windfalls like work bonuses or tax refunds, consider directing these additional funds to your savings account. Alternatively, you can allow your skimming order to accumulate extra money towards the end of the month. If you notice that your skimming order consistently gathers a specific amount monthly, adjust your automatic saving order at the beginning of the month to reflect this increase. Prioritize filling up your “Emergency Funds” and “Unexpected Things” accounts swiftly, and once achieved, indulge yourself with the “Extra Money.” You’ve earned it!

After Saving Money, When To Start Investing?

Now this question is another big topic, that we will have a very close look at in Step four! Are your tools set up and are you saving your money the way that you feel comfortable? Then have a look at step four and find out, how much money you should save before you can start investing. Also in step four, we will have a look at the long time goal for your investments and how to reach them.

4 thoughts on “Step Three: Start Saving Money”