Step One: Unable To Pay Your Debts

Learn How To Set Yourself Up to Pay Your Debts

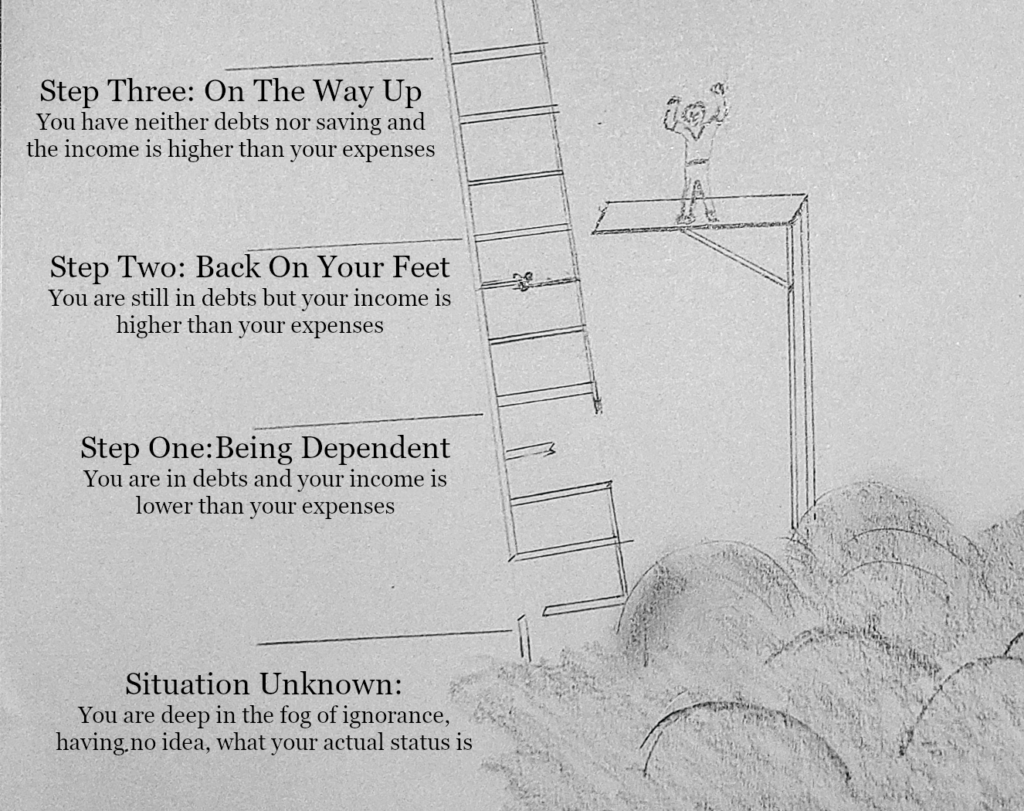

You are on step one of the financial ladder if your income lags behind your expenses, and you’re grappling with debts. In this situation, the mounting debts pose a daily challenge, creating more troubles every day. However, there is room for optimism and a path to improvement.

Firstly, your commitment to addressing your financial challenges is evident by your engagement with this article. That indicates, that you are willing to do something to get out of the worst and balance your finances. Moreover, it’s essential to recognize that you are not alone in facing financial difficulties. A substantial portion of the population, around 35 percent of adults with a credit file, totaling approximately 77 million Americans, has experienced debt in collection.

This statistic underscores that financial challenges are pervasive, affecting a significant portion of the population. Approximately 23 percent of the American population has encountered difficulty repaying debts, leading to the involvement of third-party entities for debt collection after a period of 180 days or more.

Thirdly, by now, you’ve hopefully conducted a thorough assessment of your current financial situation. This exploration likely involved identifying opportunities to enhance your income or trim your expenses, signaling your commitment to finding solutions for your dire situation.

Manage Your Income And Spendings

If you haven’t done so already, take immediate action. To navigate your way out of financial challenges, you must possess a precise understanding of your income, expenditures, debts, and savings. If you find yourself needing assistance in constructing a personal financial spreadsheet, refer to this brief guide on how to create your financial overview.

Given that you currently find yourself at step one of the financial ladder – with your income trailing behind your expenses – the steps outlined in the guide should help you with a comprehensive list detailing all incoming and outgoing finances on a monthly basis. This groundwork is crucial for laying the foundation to address and improve your financial situation..

We should then focus on things we can improve:

How To Lower Your Monthly Costs?

1.) Do Not Use Your Credit Card

A staggering 80% of Americans grapple with consumer debts. The foremost rule in your financial journey: No more debts! Safeguard your financial well-being by leaving your credit card at home and securely locking it away. Given your current income constraints, it’s imperative not to incur additional debts, particularly considering the typically exorbitant costs associated with credit card debts.

On average, credit card debts have an interest rate of around 16% per year, with some cards charging an alarming 30% annually. Failing to promptly repay such debts can lead to rapid accumulation of interest. Therefore, it’s crucial to adopt a hands-off approach to your credit card to avoid worsening your financial situation.

2.) Eat At Home

After writing down all the expenses, you will find numerious parts on that list, that could be reduced and one substantial category may be “restaurant bills.” If dining out or indulging in fast food is a regular occurrence, it’s time to reconsider. Opt for more economical food options and embrace home-cooked dinners. Additionally, forgo expensive coffee-to-go; making your coffee at home and bringing it along can save a significant amount. Choose water over soft drinks for a cost-effective and healthier alternative.

To better manage your grocery spending, a useful trick is to allocate a fixed amount of cash for the week. Consider placing around $8 per person per day for groceries. For instance, a family of three might set aside $168 per week. Stick to this budget diligently, ensuring that you don’t exceed the predetermined amount. This strategy not only aids in financial discipline but also encourages mindful spending on essential items.

3.) Not The Time For Luxuries

Then you have the segment „luxury goods“ where you will find a list of things, that warrant reconsideration or elimination. Take a critical look at monthly subscriptions, especially for the fitness center if it has been weeks since your last visit – it might be time to cancel. While services like Netflix and HBO+ provide entertainment, survival is not contingent on them. In times of financial strain, priorities must shift, and worrying about the latest episode of “Game of Thrones” should take a back seat to more essential concerns, such as maintaining housing stability. Allocate your resources wisely and trim unnecessary luxuries from your budget.

4.) Change Your Habits

While some individuals may find themselves in a precarious financial position due to unfortunate circumstances or unforeseen accidents, the majority in the initial stage of the financial ladder often got there due to indifference toward their income and spending habits. It’s probable that certain habits have contributed to your current situation. For instance, perhaps you made impulsive credit card purchases for racing parts to enhance your car, influenced by connections in the street racing scene. Subsequently, engaging in reckless driving led to legal consequences, leaving you unable to afford the resulting ticket and jeopardizing your ability to commute to work.

Furthermore, if habits such as substance use or gambling addiction are part of your life, now is great moment to break free from them. Not only are these habits financially unsustainable, but they also pose serious threats to your well-being.

5.) Dont Buy Unnecessary Things

Before making any purchase, adopt a two-fold contemplation: Is this truly a necessity? The key consideration isn’t whether you desire it but whether it is genuinely needed. If, for instance, the watch you’ve been eyeing is now 20% cheaper, ponder whether your current timepiece is functioning perfectly well. While the allure of acquiring what you desire is strong, it’s essential to recognize that there will be a more opportune moment for such indulgences. Once you’ve progressed to step two of the financial ladder and are well on your way to step three, you can contemplate treating yourself to these luxuries. Until then, exercise prudence and prioritize essential needs over wants.

6.) Reduce Costs For Housing and Energy

If you’re in need of swift relief on housing expenses, consider the option of getting a roommate. This not only injects much-needed income but also significantly slashes your spending on housing and utilities. Surprisingly, opting for a roommate may prove to be a more advantageous choice compared to moving to a cheaper apartment.

For those pondering long-term solutions, there are strategic steps to take. Reflect on how much you could save monthly by curbing water, gas, and electricity consumption at home. During the colder months, question whether heating your home to a level that allows for walking around in light clothing is truly necessary, or if wearing warmer attire and moderating the heating would suffice.

In extreme cases, homeowners might find it necessary to sell their house and transition to renting a new residence. This decision is often preferable to having debt collectors step in to sell the property, as selling on your terms allows for the repayment of debts and a more controlled financial restructuring.

7.) Paying Back Your Debts!

One of the most financially burdensome aspects can be credit card debts, often accumulating interest rates as high as 30%. Swiftly eliminating these debts is crucial to continually reduce overall expenditures.

Even if repaying your debts in full seems challenging, consider negotiating for better credit terms. A debt consolidation plan can be particularly effective, significantly lowering interest rates by consolidating expensive credits into a single, more favorable arrangement.

If a consolidation plan isn’t your preference, establish a minimum monthly payment that is feasible within your budget. Prioritize paying this amount as soon as you receive your paycheck. For more in-depth guidance on reducing debts, refer to additional information here.

Remember, a steady income is pivotal to repaying debts, and the more income you can secure, the more effectively you can manage and alleviate your financial obligations.

8.) Reduce Insurance Rates

Insurances do not have to be expensive, if you choose the right ones. Also you can reduce the costs by raising your deductible. Also it will be wise to check if you can cut any extra coverage, that you might not need at all. Lastly as there are many different insurance companies, it is wise to compare and negotiate with your insurance company for a better deal.

How To Increase Your Income

Are You Unemployed?

If you currently do not have a job: go get yourself a job as fast as possible. This is not the time to be overly selective about your employment options. Given your current financial circumstances, it’s crucial to break the downward spiral, and obtaining a job that covers your expenses is paramount. At this stage, any job that allows you to make payments towards your debts will suffice as a starting point.

Grab a newspaper and meticulously review all the job listings. Identify every job that aligns with your capabilities, emphasizing practical skills rather than personal preferences. Tomorrow morning, your first task should be to apply for each of these jobs, ensuring that they meet the financial requirements you’ve recently calculated. Taking decisive action in securing employment is a vital step in stabilizing your financial situation.

Employed, But Still There Is Not Enough Money?

If your current job falls short of covering your monthly expenses, it’s time to explore options for increasing your income. Begin by negotiating a pay raise with your employer. Companies are often open to discussions about salary adjustments, and a raise could significantly improve your financial situation.

If your current employer is unable to provide a higher salary, consider searching for alternative job opportunities that offer better compensation. Sometimes, making a lateral move to a new position can bring a substantial increase in income.

Should you have a strong preference to stay with your current company, explore the possibility of working overtime or taking on a second job during weekends or evenings. While it may require some sacrifice in the short term, the additional income generated can alleviate financial stress.

Remember, the goal is to overcome financial challenges, and putting in extra effort now can pave the way for a more secure and comfortable future. Once you’re out of immediate financial troubles, you’ll have the opportunity to regain a better work-life balance.

Get To The Next Step!

If you got things changed and you are now earning more money, than you are spending each month, gratulations! Now you can start to pay your debts! You have just moved to the next step! Read the next article on how to further improve and get closer to your final goal, whereever on that ladder you would like to be in 20 years!

What If All Fails?

If you tried your best but still you can not improve your income or lower your expenses, you might want to file private bankrupcy to get out of the troubles. This will of yourse not be funny and it will take some time, but this might be your chance to start from scrach in a few years. If you live in the United States, you can find help here https://www.usa.gov/debt

Heads up! You will be on the way up, just don’t let yourself down.