Learn About Your Personal Finances

You do not need years of practice as an investment broker to know the the essential principles of managing your personal finances. Blindly entrusting your financial well-being to a banker is unnecessary. This website is dedicated to providing comprehensive financial education for the average citizen. By establishing a long-term financial goal, you can take proactive steps to not only avoid potential pitfalls but also cultivate a path towards potentially generating passive income through strategic investments.

This is the beginner section, please start here if you have no idea at all and if you are interested in really learning about your financial improvement from scratch on. <Read more>

Get Yourself Some Financial Education Right Now!

Only 24% of millennials in the United States demonstrate basic financial literacy

National Endowment for Financial Education

It’s astonishing that despite the wealth of information available to millennials today, many still lack basic financial knowledge. A considerable number struggle to grasp even fundamental concepts, making it challenging to understand financial articles. Furthermore, there’s a noticeable gender gap in financial literacy. Female millennials are twice as likely as males to lack retirement savings. This inequality highlights the urgency of improving financial education to empower everyone, regardless of gender, to make informed decisions about their financial future. For instance, understanding concepts like ETFs could be crucial for financial well-being.

Start Gaining Some Financial Knowledge Today

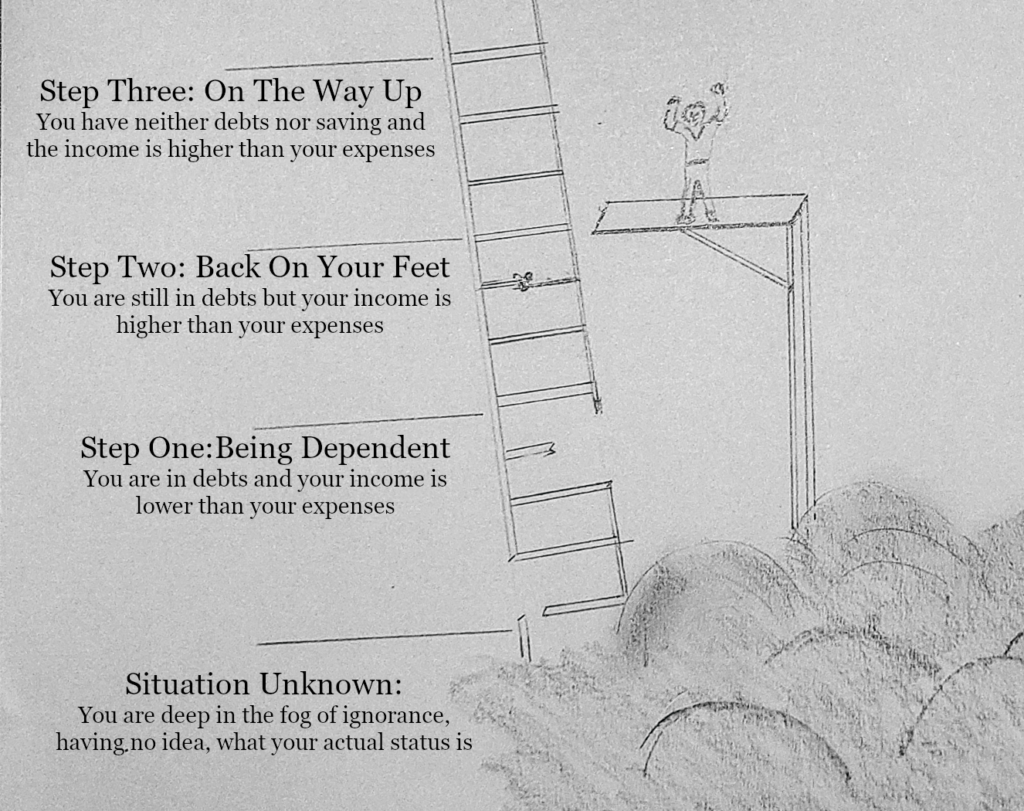

Gain valuable insights into your financial position and chart a path towards your financial goals. By assessing your income, expenses, assets, and liabilities, you’ll develop a clear understanding of where you stand financially. Set realistic goals that align with your values and priorities, whether it’s saving for a down payment, paying off debt, or planning for retirement. Regularly monitor your progress and make adjustments as needed to stay on track. Empower yourself to take control of your financial future by arming yourself with knowledge and taking proactive steps towards your goals. Learn about climbing the financial ladder!

What Is Interest And How Can I Start Saving Some Money?

Simply put, saving money means channeling funds from your checking account to your savings, but the art lies not only in saving diligently but also in optimizing the interest earned. Here, you can learn how to save money and here is an overview about why it is important to start getting interest as soon as possible. Today you are going to learn some simple concepts about how to save your money and how to start your first passive income with some interest. At its core, interest represents the cost of borrowing money or, the compensation received for lending money to someone else.

Investing Your Money – Make Your First Investment

Taking the first step to invest your money, no matter the amount, is paramount to building a solid financial future. With only little spare money in hand, now is the perfect opportunity to embark on your investment journey and set yourself on the path towards long-term financial security. By starting to invest today, you can harness the power of compounding returns and leverage time to your advantage. Whether you’re a recent college graduate, a young professional, or a savvy student with savings to spare, investing your money wisely can lay the foundation for achieving your financial goals and aspirations. Don’t wait for the perfect moment or a larger sum of money to begin investing – start now and watch your wealth grow over time.